The Federal Government has released yet more JobKeeper Rules changes. The JobKeeper scheme has now been amended seven times with the two most recent changes taking place on 10 August 2020 and 14 August 2020 as follows:

10 August 2020 Changes

The tiered payment rate applicable in the JobKeeper extension periods will now depend on the average hours worked per week for two fortnightly pay periods.

These pay periods are:

- The two fortnightly pay periods prior to 1 March 2020; or

- The two fortnightly pay periods for prior to 1 July 2020.

Eligible employees on 1 March 2020 can use the period with the higher hours.

The Commissioner has discretion to set out alternative tests where an employee has worked unusual hours during the February and June 2020 reference period. Examples include where an employee has unusual hours such as when on leave or they were volunteering during the bushfires for all or part of the reference period.

14 August Changes

Do you have any of these employees?

- Engaged in an employment relationship with you on or before 1 July 2020 but after 1 March 2020?; or

- Previously nominated as an eligible employee for another employer?

If you answered yes to one of these questions, they may be considered an eligible employee under the recently announced amended JobKeeper scheme.

These changes apply to the fortnights beginning on 3 August 2020.

What has changed?

- Full time and part time employees who were engaged in an employment relationship on 1 July 2020 will be eligible to receive the JobKeeper wage subsidy;

- Long-term (greater than 12 months) casual employees as at 1 July 2020 will be eligible to receive the JobKeeper wage subsidy; and

- Employees can re-nominate as an eligible employee of another entity provided they have ceased employment or business participation with the first entity and commenced their employment with the new entity by 1 July 2020.

Employees who are eligible under the original JobKeeper scheme rules do not need to retest their eligibility.

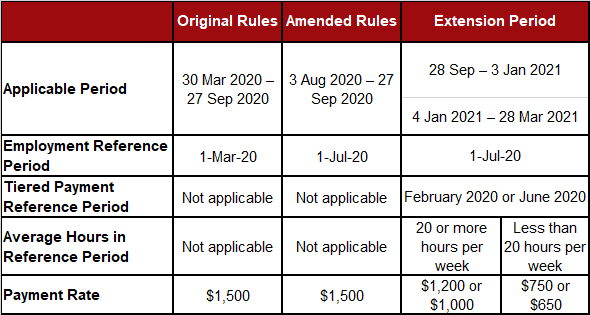

The changes to the JobKeeper scheme are summarised below:

What do you need to do?

Employers must notify all newly eligible employees (other than those already receiving JobKeeper payments) of their election to participate in the JobKeeper scheme by 22 August 2020.

To claim JobKeeper payments for the August fortnights, enrolment for the JobKeeper scheme must be completed by 31 August 2020.

For the fortnights commencing on 3 August and 17 August 2020, any top-up payments must be met for all new eligible employees (under the 1 July eligibility test) by 31 August 2020.