JobKeeper - Extended to 28 March 2021

Today, the Federal Government announced a six-month extension of the JobKeeper Payment Scheme until 28 March 2021.

The current JobKeeper Payment Scheme will continue to operate as originally legislated until 27 September 2020 with no changes made to the current eligibility for businesses.

From 28 September 2020, business and not-for-profit entities will be required to demonstrate that they have suffered an ongoing significant decline in turnover using actual (rather than projected) GST turnover.

What has changed?

- Businesses and not-for-profit entities will be required to reassess their eligibility for the JobKeeper Payment Scheme to remain eligible for the two extension periods to 28 March 2021;

- The decline in turnover will be measured using the actual GST turnover as opposed to the projected/actual GST turnover; and

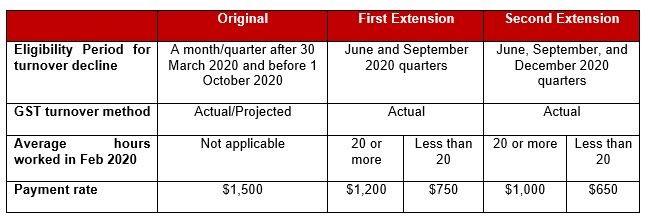

- A reduced payment rate will apply (based on average hours worked) in the first extension period and the second extension period.

These changes are summarised below:

First Extension Period - 28 September 2020 to 3 January 2021

The first extension period of the JobKeeper Payment Scheme will run from 28 September 2020 to 3 January 2021.

Businesses and not-for-profit entities seeking to claim the JobKeeper payment in the first extension period will be required to reassess their eligibility for the JobKeeper Payment Scheme for this period, with reference to actual GST turnover in the June 2020 and September 2020 quarters, when compared with the corresponding 2019 quarters.

The decline in turnover must be met for both quarters.

The payment rate from 28 September 2020 to 3 January 2021 will be reduced to $1,200 per fortnight for eligible employees and business participants who worked 20 or more hours a week on average in the month of February 2020.

Eligible employees and business participants who do not meet the average hours worked requirement will be entitled to a reduced rate of $750 per fortnight.

Second Extension Period - 4 January 2021 to 28 March 2021

The second extension period of the JobKeeper Payment Scheme will run from 4 January 2021 to 28 March 2021.

Businesses and not-for-profit entities will need to meet a further decline in turnover test using actual GST turnover in the June 2020, September 2020, and December 2020 quarters relative to the comparison periods (i.e. June 2019, September 2019 and December 2019).

Further reductions to the payment rate will also apply for this period. Eligible employees and business participants who worked 20 or more hours on average in the month of February 2020 will be entitled to $1,000 per fortnight.

Eligible employees and business participants who do not meet average hours worked requirement will receive $650 per fortnight.

Reassessment Timing

It is unclear when the reassessment confirmation needs to be reported to the Australian Taxation Office. However, the Federal Government has stated that the JobKeeper eligibility will need to be met in advance of the September 2020 and December 2020 quarterly Business Activity Statement lodgement deadline.

Based on the original rules, we expect that this will need to be completed at the same time as the monthly JobKeeper declaration report which must be submitted within 14 days of the end of each JobKeeper month.

Further Information

On Tuesday 28 July, Hall Chadwick will be holding a breakfast business masterclass focusing on Josh Frydenberg's economic update (Thursday 23 July 2020) and this freshly announced JobKeeper Payment Scheme extension. For more information, click here.

Please Note: Many of the comments in this publication are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information's applicability to their particular circumstances.