On 15 September 2020, the Federal Government announced that the JobKeeper scheme would be extended beyond the initial end date of 27 September 2020 to further assist businesses affected by COVID-19.

The Treasurer has released the amended JobKeeper Rules that incorporate the key changes announced. It has also been confirmed that the JobKeeper extension is available to existing businesses claiming the JobKeeper payment, as well as new JobKeeper registrations.

Key changes

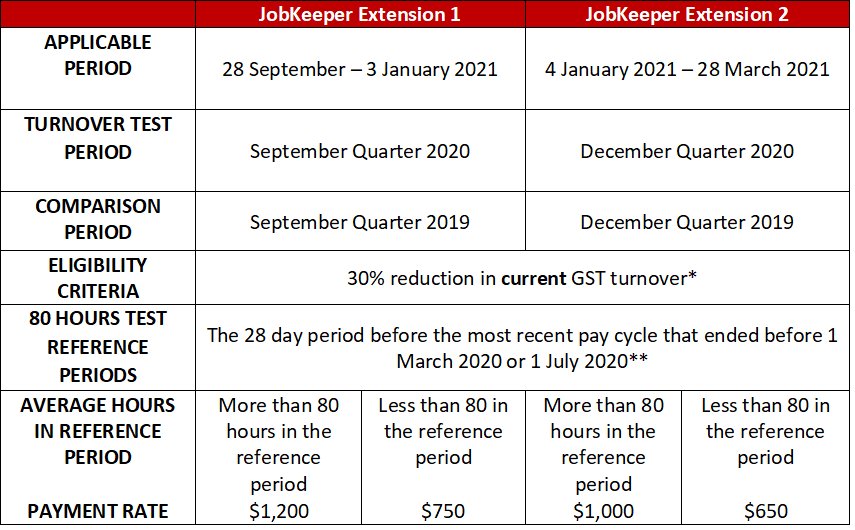

The key changes are summarised in the table below:

*Not-for-profit's and ACNC registered charities require a 15% reduction in current GST turnover

**Eligible Business Participants can only apply the 80 hours test for the month of February 2020.

Key dates

All businesses can enrol for JobKeeper Extension 1 between 1 October 2020 and 31 October 2020.

This process of enrolment can be done on the business portal or alternatively through the Tax agent portal.

Additionally, the ATO will allow until 31 October 2020 for businesses to satisfy the wage condition (including paying top-up payments) for the following JobKeeper fortnights:

- Fortnight 14 (28 September - 11 October)

- Fortnight 15 (12 October - 25 October)

Businesses will need to complete the October monthly business declaration between 1 November 2020 and 14 November 2020. In this declaration they will notify the ATO of the payment tier being claimed for each eligible employee.

What you need to know

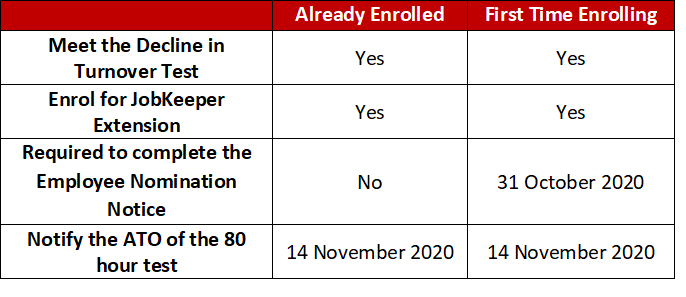

The required action from most businesses to ensure that they receive the first JobKeeper extension payments are summarised below:

80 hour test

The Federal government has introduced the 80 hour test to distinguish between full time and part time employees. As mentioned earlier, there has been an introduction of tiered payments which impact the amount of JobKeeper payments that are received.

The 80 hour test requires an eligible employee to work 80 hours or more in their 28 day reference period. The 80 hours of work consists of actual hours worked, hours on paid leave and hours paid for absence on a public holiday.

The payment rates as outlined in key changes table refer to a higher payment rate for employees that have worked more than 80 hours in the reference period and a lower rate for those employees that worked less than 80 hours in the reference period.

Changes to Alternative test

On 22 September 2020, the Treasurer released a new legislative instrument outlining the alternative tests to coincide with the Extended JobKeeper rules.

The alternative tests are applicable where there is not an appropriate comparison period for the purpose of the decline in turnover test.

The alternative tests may be applied in the following circumstances:

- Newly commenced businesses;

- Business acquisition or disposals;

- Business restructures;

- Businesses affected by drought or natural disaster;

- Businesses with irregular turnover; or

- Sole traders or small partnerships with sickness, injury or leave.

The new alternative tests remain broadly in line with the original alternative tests with minor adjustments to align dates.

Calculating the decline in turnover

In general terms, the current GST turnover of a business is the value of supplies made in a relevant period. Determining the value of supplies in the relevant period can be a complex and strenuous undertaking.

Recently the ATO have released a Fact Sheet indicating that for most businesses, the figure reported in their Business Activity Statements (G1-1A) should equal the current GST turnover of the entity.

It is clear from a legislative approach that this is not always the case.

Businesses that determine they are eligible for the JobKeeper extension periods based on their BAS figure may not be eligible when applying the concept of current GST turnover and could potentially expose themselves to penalties.

Similarly, businesses could conclude that they are not eligible for the JobKeeper extension periods based on their BAS however may actually be eligible.

What you need to do

Businesses that intend to claim for the JobKeeper extension 1 need to do the following:

- Determine that they are eligible based on the actual decline in turnover test;

- Enrol their business by 31 October 2020; and

- Determine which employees are eligible for the higher and lower payment rates by 14 November 2020.

There is much complexity associated with determining the eligibility based on actual decline in turnover, enrolling for the JobKeeper scheme and determining which employees are eligible for the higher and lower payment rates.

Our professional team here at Hall Chadwick are equipped to handle these new changes. We are up to date on all the JobKeeper amendments and can correctly advise businesses on their eligibility for the JobKeeper program.